your gateway

into the world of startup investments

Your access to curated and innovative startup investments from € 10,000 with our business angel platform.

Gateway is known from:

Through joint investment (invest), mutual support and bundled expertise (contribute), founders and investors benefit from this interaction (benefit) when investing in startups with our business angel platform. With us as your venture capital partner, the exit is always in sight.

invest.

Invest privately from €10,000 in the most promising start-ups. Our experienced venture capital team will guide you through your start-up investment. With our curated start-ups, we place great value on innovation, a good business model, stable turnover and meaningful investments.

contribute.

Our community has the opportunity to become actively involved in start-up deals. This allows private investors to contribute directly to the success of the startup. By participating in startup deals, members can also contribute their expertise and experience to promote the success of the startup.

benefit.

Through high return potential, a focus on careful calculated risks, events and an active angel & startup community, we work to provide the best investment experience for startups, established business angels, first-time investors and family offices. Benefit with Gateway Ventures!

Current Campaigns: Innovative Startups

Discover promising deals, set course for returns and start your startup investment journey with Gateway Ventures. Discover young companies as an investment!

Curious? We are your gateway to the world of startup investments

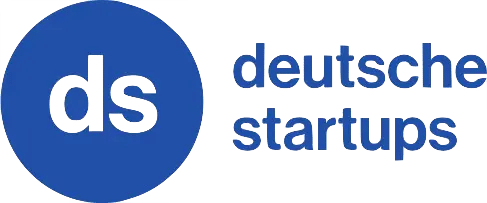

Our Startup Investment Portfolio

Over 45 start-ups and more than 4.000 investors are already benefiting from Gateway Ventures.

Over the last 7 years, hundreds of our active investors have invested almost €28 million in 45+ start-ups. Our portfolio has grown in value by 2,16x. We enable investments in the promising European startup scene. We focus on solutions in the areas of business services, sustainability and health and invest along the seed and growth phases.

Paul Kolarik

Geschäftsführer

Katja Ruhnke

Unternehmerin und Investorin

CK Ventures

Conny Hörl

Unternehmerin und Investorin

CK Ventures

Annette Jordan

Business Angel

Inhaberin Annette Jordan Organisationsberatung

Heinz Raufer

Business Angel

nebenan.de, tripmakery, hotel.de, flixbus

Eveline Steinberger Kern

Business Angel

weXelerate, BlueMinds Group, Digital Hero

We invest a lot of time in the targeted selection and examination of our start-ups in order to be able to offer investors the most promising deals

Deal Sourcing

Our Deal experts proof over 1.000

start-ups yearly from all over Europe.

Only the best 1-2% make it through

our screening process.

Deal Preparation

We handle the contractual obligations

between start-ups and our co-investors.

All the documents needed in order to

diligently assess the start-up are

transparently shared on our online platform.

Post Investment

You will regularly receive standardised

updates on the development of all your

start-up investments. Moreover, you will

be able to support the founding team through

your own personal network or expertise,

being a catalyst for growth.

Meet the founders

Personally meeting the team is decisive.

With Gateway Ventures you have the

opportunity to meet the founding team

from the comfort of your home, from

assessing the details of the deal, to directly

investing into the next big success story.

Current Events

Talks, Meetups, Webinars and much more. Discover our current events!

15

August

2024

Getting started with Start-up Investments

19

June

2024

Webinar Valuation

Stay informed

Your gateway to exciting deals, important information and innovative developments

- Receive exciting monthly updates on our portfolio start-ups

- Insights into the latest developments in the start-up scene

- Reports on the latest technologies

- Gateway Ventures news and updates

FAQs

Our answers to the most frequently asked questions from business angels, start-ups, investors and partners.

How does Gateway Ventures work?

That’s hard to answer in two sentences, but we’ll try! Our goal is that you have a great investment experience from the moment you get to know a company until you sell your shares.

For this, we select the best start-ups and often times fight to get into competitive deals with attractive co-investors.

For the approx. 12 of 1000 startups that make it through, we prepare all the necessary information, so you don’t have to go through everything. We will notify you via email of new opportunities and via the platform, you’ll be able to dive deeper into any given startup, meet the founders and invest.

Lastly, when “closing the round” we talk to the lawyers and make sure to get the fairest deal for both sides.

Once the investment is through, we are in regular contact with the start-up and you, the investors, to provide the reporting and see how both sides can continue benefiting from each other.

Do I have to pay to join Gateway Ventures?

Why is 10.000€ the minimum investment sum?

Our goal was to make it 10 times more accessible than a VC fund, in which you can typically start to invest with 100.000€.

Additionally, we needed to find a balance between accessibility for investors and what the startups and co-investors would accept.

We are already allowing smaller tickets if we see that your value add to the startup is large enough.

Gateway is known from: