Investment process

invest.contribute.benefit

Through joint investing (invest), mutual support and bundled expertise (contribute), founders and investors benefit from this interaction.

How we work

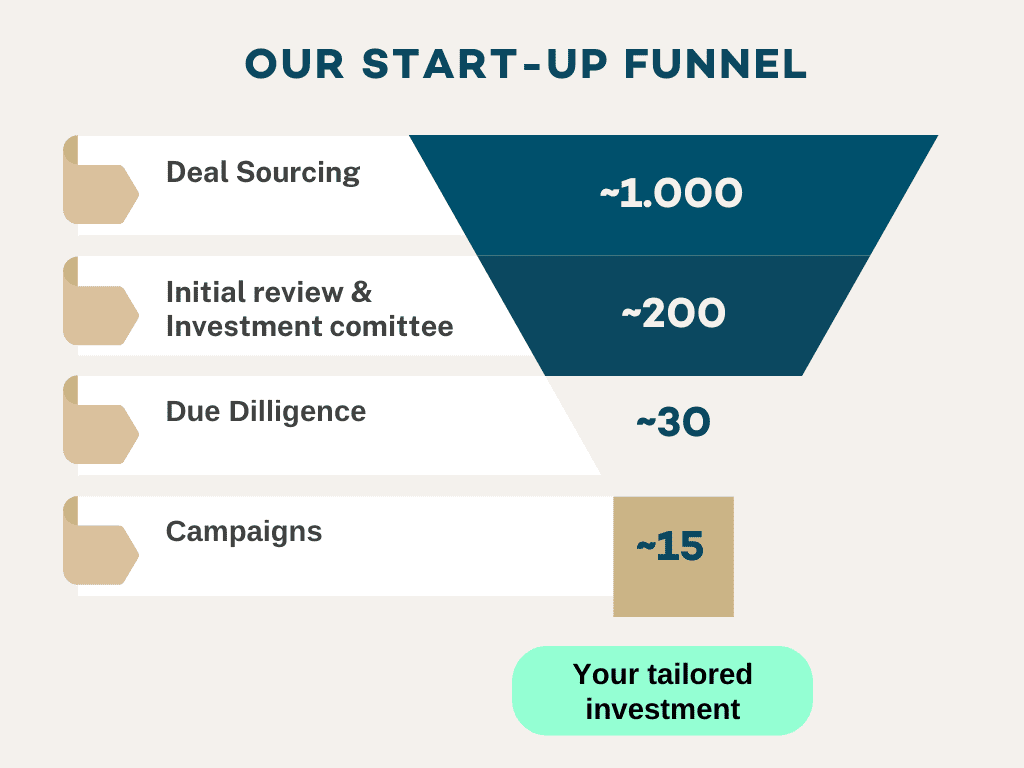

Of the hundreds of companies our team evaluates each year, only a handful of startups make it through our rigorous selection process.

We see ourselves not only as a “funder”, but as a long-term partner and advisor to our portfolio start-ups.

To ensure that we only select the most promising start-ups and present them to our investor:s, we have developed a multi-stage process that ensures the highest quality of our campaigns.

This process includes a detailed review consisting of numerous meet-ups with the founding team, interviews with industry experts and partners, and a thorough analysis of the company’s documentation.

Of the countless companies our team evaluates each year, only a handful of startups make it through our rigorous selection process.

Our fundraising process is time and cost efficient and takes approximately 8 to 12 weeks.

Deal Sourcing

We have a whole team of investment analysts looking for the best ideas. Every year we review hundreds of startups and take hours of work away from our investors.

Through our years of experience, expertise and international network, we have direct access to the most promising founders across Europe.

Investment Committee

Our Investment Committee (IC) meets once a week to discuss which companies we will continue with.

The decision is largely based on parameters such as business model, cap table, financial plan. In addition, factors such as team, traction, growth, etc. are reviewed.

Our network is an important reason why startups fund with us, so we also evaluate if the idea and product is such a good fit for us that we can also support appropriately

Initial check

In an initial analysis, our analysts check whether the basic criteria fit. These include phase, industry, vertical, geography, market analysis, among others.

We discuss any ambiguities and conduct personal calls with the start-up to get a feel for the team and product. Here we are as objective as possible to evaluate opportunities and risks as best we can.

Regardless of whether our decision is positive or negative, we give the founders constructive feedback for the way ahead.

Due Diligence

As soon as our Investment Committee gives the green light, we start a comprehensive operational review.

Depending on how technical a solution is, we consult with experts from our network.

We conduct analysis of all key areas required, such as economics, finance, technology, legal and human resources. During this time, we are in close contact with the start-up in case any ambiguities arise.

Go Live & Founder Meet-up

As soon as a new campaign is live on our platform, they receive an email. Investors get access to all relevant information to make an informed investment decision, including an online profile, a term sheet and due diligence documents. We also organize Founder Meet-ups within each campaign, which you can attend virtually.

All information as well as the Meet up are free of charge and are designed to help you make an informed investment decision.

Direct investment

All information required for an investment decision is provided directly on our digital platform.

Once this decision has been made, the investment process is handled digitally via the Gateway Ventures platform.